Looking to your Indigo Credit Card at Indigocard.com Activate? It’s easy! Whether you’re online or prefer a phone call, our guide at indigocard.com/activate helps you get started in no time. Unlock your card’s benefits and manage your account effortlessly. Follow our simple steps and enjoy seamless spending today!

Contents

Requirements for a Indigocard.com Activate

- Credit Card: Have your Indigo Credit Card ready.

- Account Number: Know your card’s account number.

- Identification: Provide your date of birth and Social Security Number (SSN).

- Internet Access: Ensure you have a stable internet connection for online activation.

- Phone Access: For phone activation, have a device to call customer service.

MyIndigo Credit Card – Indigocard.com Activate (By Online)

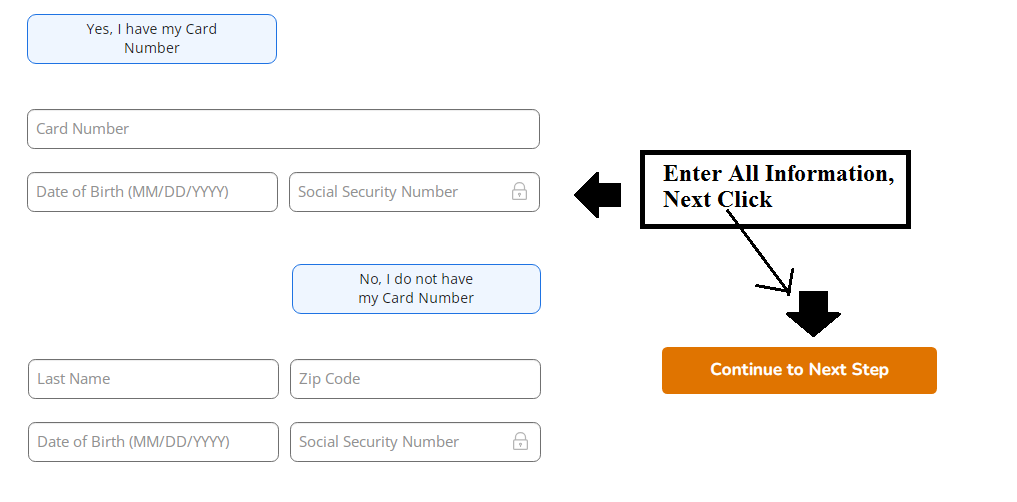

To activate your IndigoCard online, simply follow these steps:

- Visit the official IndigoCard activation website at www.indigocard.com.

- Click on the “Activate Card or Register” tab.

- Enter your account credentials, including your username and password.

- Input your card details as prompted.

- Assign a PIN to your IndigoCard.

- Confirm the details and click on the “Activation” button.

- A confirmation message will be displayed, and you will also receive an email confirmation (Indigo Card).

MyIndigo Credit Card – Indigocard.com Activate (By Phone)

To activate your IndigoCard, contact customer care at 1 800 353 5920. A representative will walk you through the activation procedure for the Indigo Card.

Check Below Usefull Link:

Benefits and Key Information

- Building Credit: Reports to TransUnion, Equifax, and Experian, aiding in credit score improvement through regular payments.

- Pre Qualification: Offers a soft check pre qualification to gauge approval odds without impacting credit score.

- Fees and Costs: Annual fee ranges from $0 to $99 based on credit profile, no security deposit required, but has a high 29.99% APR and lacks rewards/cash back.

- Credit Limit and Usage: Starts with a $300 limit, which may not increase, emphasizing the importance of low credit utilization.

- Customer Service and Support: Provides a support hotline for queries and accepts payments via debit cards.

Conclusion

The IndigoCard is an excellent solution for anyone wishing to improve or create credit, since it requires no deposit and allows for fast pre qualification. It is essential, however, to weigh its expenses and hefty APR against the possible credit building advantages. To get the most out of the IndigoCard, read the rules carefully and utilize credit responsibly.

FAQs

Q1. How do I activate my new Indigo card?

Ans: To activate your new Indigo card, visit IndigoCard.com and input your account and card information, or contact customer care by phone.

Q2. Does Indigo Mastercard have a mobile app?

Ans: The information supplied does not provide a mobile app for the Indigo Mastercard.

Q3. Where can I use my Indigo credit card?

Ans: Your Indigo credit card may be used wherever Mastercard is accepted, which includes a variety of retailers globally.

Q4. Can you use Indigo credit card at ATM?

Ans: Yes, you may use your Indigo credit card at ATMs to get cash advances, however fees may apply.