The Indigo Credit Card is a popular financial tool for those looking to rebuild or improve their credit score. This article provides a detailed overview of the Indigo Credit Card, including login procedures, features, customer support.

Contents

What is the Indigo Credit Card?

The Indigo Credit Card, issued by Concora Credit Inc., is a sensible option for people who want to manage their finances easily. This Celtic Bank card comes with various online features that can be accessed through IndigoCard.com, making it a dependable alternative for everyday use.

How To Indigo Credit Card Login

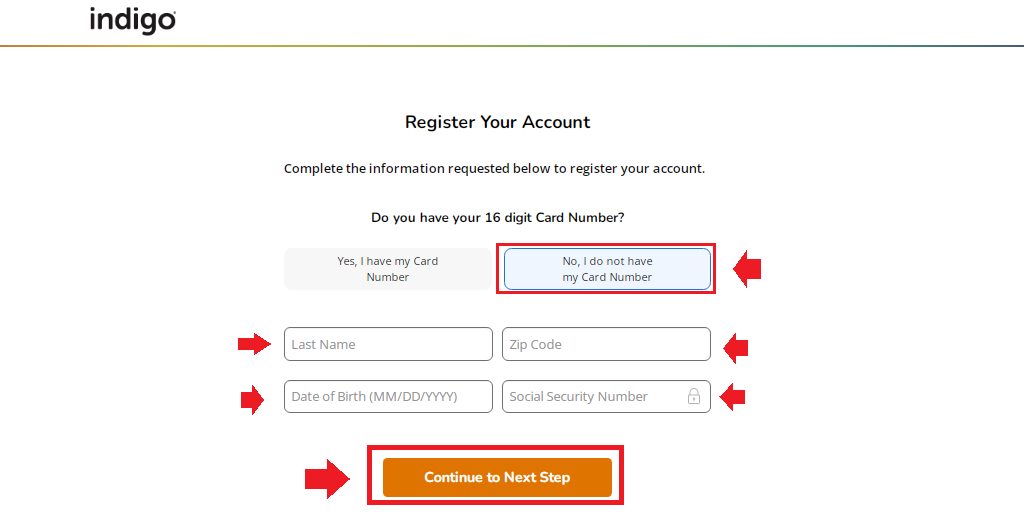

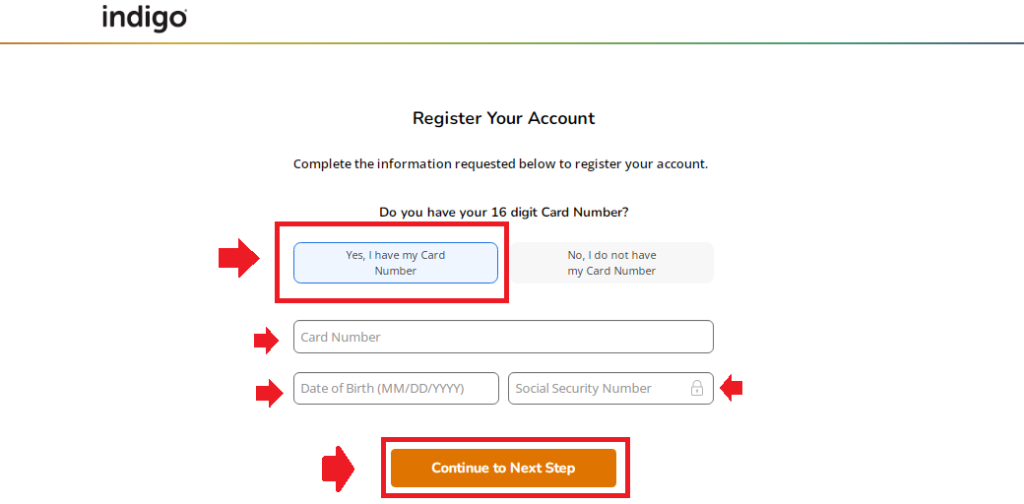

Step 1: Register Your Account

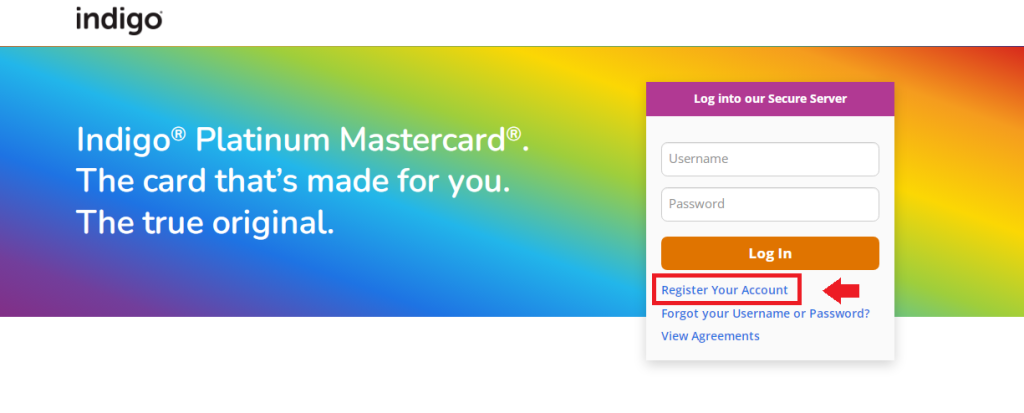

- Visit the official IndigoCard website at www.indigocard.com.

- Click on the “Register Your Account” section.

- Follow the instructions on the screen to create your login details.

Step 2: Logging In

- Once registered, go back to the IndigoCard website.

- Enter your username and password.

- Provide your account number, date of birth, and SSN for verification.

- Click the “Login” button to access your account.

Managing Your Account: Easy and Secure

- 24/7 Access: You can view your balance, transactions, and statements anytime.

- Secure Payments: Make payments securely with their protected system.

- AutoPay: Set up AutoPay for hassle-free monthly payments.

Payments: Methods and Tips

Online Payments:

- Log in to your account and use the “Bill Pay” tab. Ensure payments are made before 5 pm PT for same-day processing.

Phone Payments:

- Call 1-866-946-9545 to make payments over the phone.

Mail Payments:

Send checks or money orders to:

Indigo Platinum Mastercard

P.O Box 23039

Columbus GA 31902-3039

Avoiding Late Fees:

- Set up automatic payments to avoid late fees, which can be as high as $40

Customer Support

Contact Indigo card support for any queries or issues. Reach out to them at 1-866-946-9545 or 888-260-4532 for lost or stolen cards. Fax support is available at 503-268-4711

Conclusion

The Indigo Credit Card is an excellent option for anyone looking to improve their credit. Its user friendly online portal and different payment choices make budgeting easier. However, to increase your credit score, be aware of prospective fines and endeavor to make timely payments.